Did YC pull the fire alarm?

If you haven't already seen the email sent to the YC portfolio, it's attached to my tweet below...

Two (2!!) New Podcast Episodes

Today's bonus episode is all about the YC letter -- and how 2022 is kinda-the-same-but-really-kinda-different than 2008.

And yesterday's weekly episode covers dominant shareholder issues, the strategy of negotiating in public and some ideas around the future of work.

Riveting stuff, I know. But having invested in thousands of founders over the last decade, these are the sorts of things discussed on the investor side of the table on a regular basis.

Grab them on Apple Podcasts, Spotify Podcasts or Google Podcasts -- and let me know what you think! 🙏🏼

***

If you're watching the news (or your social media feeds), most of the rhetoric these days is focused around the potential magnitude of whatever is-or-isnt heading our way. Ignore all of that noise.

It's not the magnitude of things that will cause problems for entrepreneurs over the next 6-12 months. It's the uncertainty.

When employees are uncertain, they start job hunting.

When founders are uncertain, they make poor judgements.

When investors are uncertain, they reserve additional capital for existing portfolio companies.

The point is that we should all be prepared to weather the uncertainty of the next few months.

In last week's episode, I hinted at a Google Spreadsheet template we've been using to prepare our own business for uncertainty. It turns out, hundreds of listeners messaged me for a copy... rather than reply to every email and DM, here's a link to the template (and a sample screenshot of our current version).

***

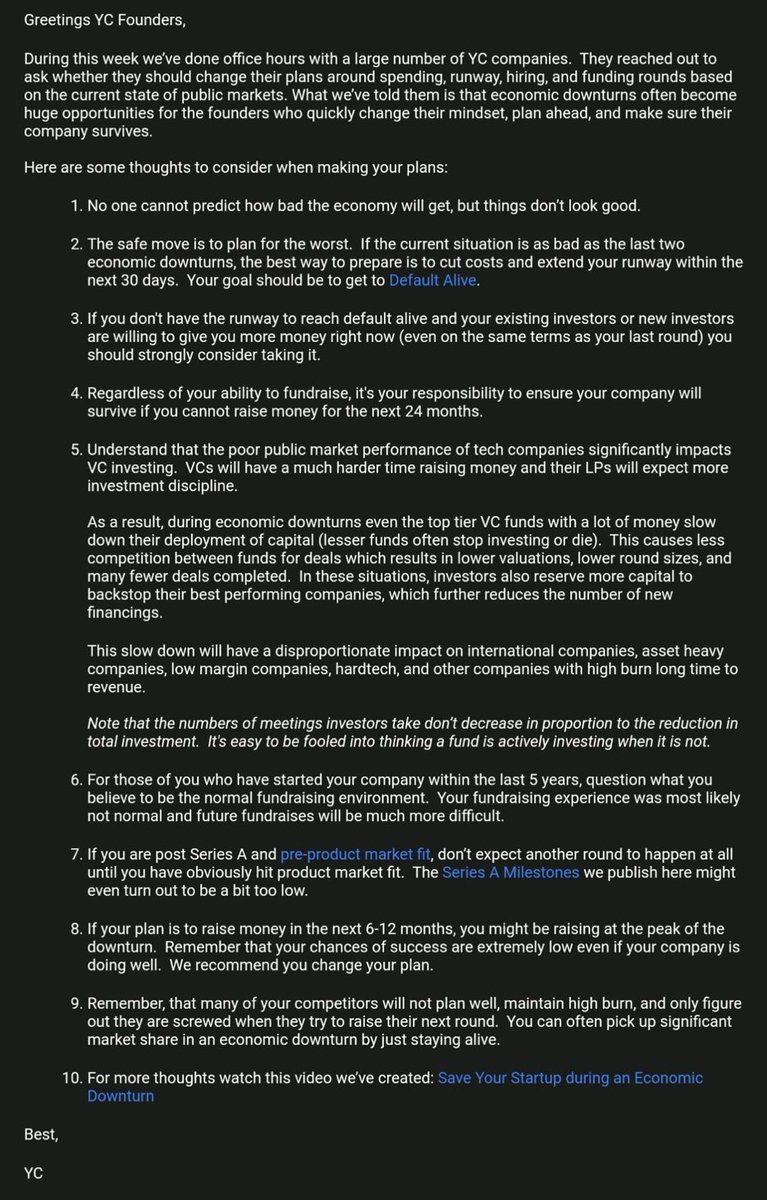

And, since you've made it this far... here's that letter from YC. 😅

May 19th 2022

|

Have a great weekend!

-P

PS -- I really hope you'll give the podcast a listen. 🙏🏼

PPS -- will you please consider sharing the podcast with at least one other person that might find it useful? 🙏🏼😅

Hey, I'm Paul Singh. 👋🏻

I run Results Junkies. We invest our own capital into ~200 new companies across North America each year. I write about growing your startup, career and/or business... everywhere else. Join 1,000,000+ other Results Junkies now.

Happy Friday (from a coffee shop in balmy Sioux Falls, SD this morning)! Ed and I spent some time at a local pitch event last night, it's been a good reminder that, for the most part, access to capital isn't the problem. The thing about money is that it accelerates what's already happening. You spent 80% of the meeting talking about all your features? I have a prettttyyyyy good idea on what you'll spend 100% of the investment on. 😬 Between the macroeconomy and the rise of entrepreneurship...

Happy Friday! On my mind this week: "Invest in brand, or pay more in CAC forever and ever." As much as I want to take credit for this one, it was a friend's tweet that caught my eye. However you slice it, third-party relationships (ie, PPC, sponsorships, etc) are short-term and first-party relationships (ie, your own brand, email list, etc) are forever. 💫 *** New episode: Joe Rogan's Next Big Payday And Spotify Pivots On Distribution Joe Rogan is resetting the market again with an incredible...

Happy Friday! On my mind this week: most entrepreneurs fear the wrong thing. Growth is fun. Failure sucks. But the absolute worst thing that can happen is being stuck in something that's not-quite-growing-but-not-quite-dead. "We haven't monetized this yet but I've been working on this for almost a year! I'm gonna figure this out." 🚩🚩🚩 This is true for investors too: the worst case scenario is having your money tied up in a company that's not-quite-growing-but-not-quite-dead. (PSA: we write...